Projected Increases in Healthcare Costs for 2025: Prepare Now

Healthcare costs in the US are projected to increase significantly in 2025 due to inflation, aging demographics, technological advancements, and rising prescription drug prices, necessitating proactive financial planning and engagement with healthcare providers to mitigate the impact.

For many Americans, the specter of rising healthcare costs looms large, often overshadowing financial stability and peace of mind. As we look towards the near future, precisely, What are the Projected Increases in Healthcare Costs for 2025 and How Can You Prepare? Understanding these trends is not just about numbers; it’s about safeguarding your health and financial future.

Understanding the Current Landscape of Healthcare Costs

The American healthcare system is a complex mosaic of providers, insurers, and government regulations, each contributing to a dynamic and often unpredictable cost environment. Historically, healthcare expenditures have consistently outpaced general inflation, a trend that shows no signs of abatement. This sustained growth is driven by a confluence of factors, including the escalating costs of prescription drugs, the increasing prevalence of chronic conditions requiring long-term care, and the continuous advancement of medical technologies that, while life-saving, often come with hefty price tags. The interplay of these elements creates a perpetual upward pressure on premiums, deductibles, and out-of-pocket expenses for individuals and families.

Medical innovation, while a clear benefit to public health, also serves as a significant cost driver. New diagnostic tools, advanced surgical techniques, and groundbreaking pharmaceuticals offer unparalleled treatment options but are developed at immense expense, which is then passed on to consumers. Furthermore, the administrative overhead within the healthcare system is notoriously high, absorbing a substantial portion of healthcare spending. This includes the complexities of billing, coding, and claims processing that add layers of bureaucracy and cost. The fragmented nature of insurance coverage, coupled with varying network agreements, further complicates the landscape, making it challenging for consumers to predict and manage their healthcare expenses effectively.

Adding to this complexity is the demographic shift towards an aging population. As baby boomers transition into their senior years, the demand for healthcare services, particularly specialized care for age-related conditions, intensifies. This demographic pressure strains existing resources and increases overall utilization rates. Moreover, lifestyle factors contribute significantly to healthcare costs. The rising rates of obesity, diabetes, and heart disease, often linked to modern lifestyles, necessitate more extensive and ongoing medical interventions. These conditions, which are largely preventable, place a considerable burden on the healthcare system, driving up costs for everyone.

The current economic climate also plays a role, with inflation impacting everything from medical supplies to labor costs for healthcare professionals. These inflationary pressures ripple through the system, leading to higher prices for medical procedures, hospital stays, and outpatient services. The cumulative effect of these various factors ensures that healthcare costs remain a pressing concern for policymakers, employers, and individuals alike. Navigating this intricate landscape requires not only an understanding of the forces at play but also a proactive approach to managing personal healthcare finances.

Key Drivers of Healthcare Cost Projections for 2025

As we peer into 2025, several key drivers are predicted to propel healthcare costs upward. Understanding these specific catalysts is crucial for both macro-level policy planning and individual financial preparedness. Inflation, a broad economic force, directly impacts the cost of medical goods and services. From the price of syringes and surgical masks to the salaries of nurses and doctors, every component of healthcare delivery is subject to inflationary pressures, making treatments more expensive.

Inflation and Supply Chain Disruptions

The lingering effects of global supply chain disruptions, exacerbated by geopolitical events and environmental factors, continue to influence the availability and cost of medical equipment and pharmaceuticals. When supplies are scarce or transportation costs are high, these increases are inevitably passed on to consumers through higher prices for medical procedures and prescription drugs. The volatile nature of these supply chains means that cost predictability remains a challenge for healthcare providers and insurers.

- Increased operational costs: Hospitals and clinics face higher expenses for basic supplies due to stretched global supply chains.

- Higher labor costs: Inflationary pressures lead to demand for wage increases in the healthcare sector, impacting overall service costs.

- Volatile drug pricing: Manufacturing and distribution hurdles can cause sudden spikes in medication prices.

Aging Population and Chronic Disease Burden

The demographic shift evident in the United States, with a growing proportion of its population entering older age brackets, is a significant long-term driver of healthcare expenditure. Older adults typically require more frequent and intensive medical care, including specialized services for age-related conditions such as arthritis, dementia, and cardiovascular diseases. This demographic trend exacerbates the demand for geriatric care, long-term care facilities, and specialized medical treatments.

Furthermore, the prevalence of chronic diseases continues to rise. Conditions like type 2 diabetes, heart disease, and various cancers often require ongoing management, regular monitoring, and expensive treatments. The costs associated with these chronic illnesses are substantial, encompassing frequent doctor visits, prescription medications, specialized therapies, and potential hospitalizations. The increasing burden of these diseases places immense pressure on the healthcare system and contributes significantly to overall cost inflation.

Advancements in Medical Technology and Pharmaceuticals

Technological progress in medicine is a double-edged sword. While it enables more accurate diagnoses, less invasive treatments, and life-saving interventions, it also introduces costly innovations. New diagnostic imaging techniques, robotic surgery, advanced prosthetics, and personalized gene therapies represent breakthroughs that improve quality of life and extend longevity, but their development and implementation often come with substantial initial investments and ongoing maintenance costs. These costs are then integrated into the fees for medical procedures and services.

The pharmaceutical industry similarly contributes to rising costs through the development of novel drugs. While these drugs can offer effective treatments for previously untreatable conditions, their research and development expenses are often recouped through high retail prices. Specialty drugs for rare diseases or advanced cancers are particularly expensive, and their increasing usage plays a major role in escalating overall pharmaceutical spending. The balancing act between access to groundbreaking treatments and containing their costs remains a central challenge within the healthcare economy.

Specific Projections and Their Implications for 2025

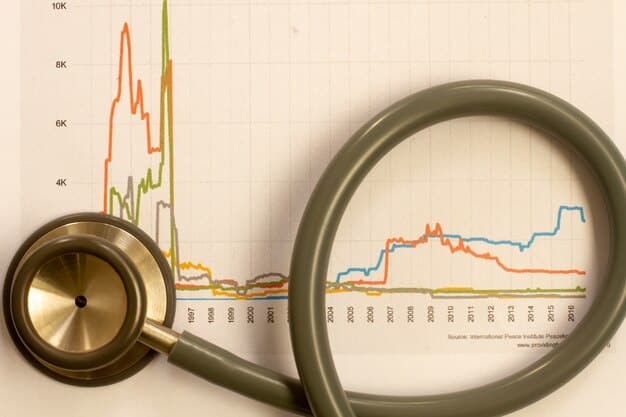

While precise figures can vary based on different economic models and unforeseen circumstances, several reputable organizations provide annual projections for healthcare cost increases. These projections generally indicate a continued upward trajectory, albeit with some nuances depending on the specific segment of the healthcare market. For 2025, it is commonly anticipated that employer-sponsored health plan costs could rise by percentages ranging from single-digits to low double-digits, influenced by the aforementioned factors.

For instance, analyses often suggest that overall medical trend rates – the expected increase in healthcare costs – might hover around 6-8% annually. This includes increases in hospital inpatient and outpatient care, physician services, and prescription drugs. However, some outlier categories, particularly specialty prescription drugs, could see much higher increases, impacting overall averages significantly. The implications of these projections are far-reaching, affecting not only individuals but also employers and government healthcare programs.

For individuals, these projections translate directly into higher premiums for health insurance plans, increased deductibles, and greater out-of-pocket expenses for medical services and medications. Even with insurance, a larger portion of healthcare costs may fall directly on the patient, potentially leading to difficult financial choices or postponed care. For those on fixed incomes or without robust insurance coverage, these increases can be particularly burdensome, potentially pushing them into medical debt.

Employers, who largely shoulder the burden of employee health benefits, will also feel the pinch. Rising healthcare costs necessitate tough decisions regarding plan design, employee contributions, and overall benefit packages. Some employers might opt for higher deductibles, increased co-pays, or a shift to high-deductible health plans coupled with health savings accounts (HSAs) to mitigate their own expenses. This, in turn, shifts more financial responsibility onto the employees.

Government programs like Medicare and Medicaid are not immune to these trends. As healthcare costs rise, so does the financial strain on these public programs, potentially leading to discussions about benefit adjustments, eligibility changes, or increased taxpayer contributions. The sheer scale of these programs means that even modest percentage increases translate into billions of dollars in additional spending, creating significant fiscal challenges for federal and state budgets. The collective impact highlights the urgent need for strategic planning and proactive measures across all sectors.

Strategies for Individuals: Preparing for the Rise

For individuals and families, preparing for rising healthcare costs requires a proactive and multi-faceted approach. Financial planning is paramount, beginning with a clear understanding of your current healthcare spending and potential future needs. This involves reviewing your insurance plan annually, understanding its benefits, deductibles, and co-payment structures. Knowing what your plan covers and what it doesn’t can help you avoid unexpected out-of-pocket expenses.

Financial Planning and Savings

One of the most effective ways to mitigate the impact of increased costs is to build a dedicated healthcare savings fund. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are excellent tools for this purpose, offering tax advantages for funds used for qualified medical expenses. Contributing regularly to these accounts can provide a financial cushion for deductibles, co-pays, and other out-of-pocket costs that are likely to increase.

- Utilize HSAs/FSAs: Maximize contributions to tax-advantaged accounts for future medical expenses.

- Build an emergency fund: Set aside savings specifically for unexpected medical emergencies or high-cost treatments.

- Budget for healthcare costs: Incorporate estimated premium increases and potential out-of-pocket maximums into your annual budget.

Optimizing Health Insurance Coverage

Periodically reviewing and optimizing your health insurance coverage is a critical step. During open enrollment periods, compare different plans available through your employer, the Affordable Care Act (ACA) marketplace, or private insurers. Consider factors beyond just the monthly premium, such as the deductible, out-of-pocket maximum, network of providers, and prescription drug coverage. A plan with a slightly higher premium but lower deductibles or better coverage for your specific medical needs might save you money in the long run.

Exploring higher deductible plans paired with HSAs can be a smart strategy for healthier individuals or those with significant savings, as it often results in lower monthly premiums. However, ensure you have sufficient funds in your HSA to cover the deductible if needed. Don’t shy away from consulting with a financial advisor or an insurance broker who can provide personalized guidance based on your financial situation and health needs.

Preventative Care and Wellness

Investing in preventative care is perhaps the most fundamental and cost-effective strategy. Regular check-ups, screenings, and vaccinations can help identify potential health issues early, preventing them from escalating into more serious and expensive conditions. Maintaining a healthy lifestyle through diet, exercise, and stress management contributes significantly to overall well-being and can reduce the likelihood of developing chronic diseases that incur substantial long-term healthcare costs. Proactive steps towards wellness can be your best defense against escalating medical bills.

Strategies for Employers and Policymakers

While individuals bear much of the direct burden of rising healthcare costs, employers and policymakers play a crucial role in shaping a more sustainable and equitable healthcare future. For employers, the increasing cost of providing health benefits impacts their bottom line and competitiveness. Their strategies often involve a mix of cost-containment measures and investment in employee well-being.

Employer-Led Initiatives

Employers are increasingly exploring innovative benefit designs beyond traditional insurance plans. This includes implementing value-based care models, where providers are reimbursed based on patient outcomes rather than the volume of services. Such models incentivize efficient, high-quality care, potentially reducing unnecessary procedures and associated costs. Employers are also encouraging the use of telehealth services, which can offer convenient and often more affordable access to medical consultations, reducing the need for costly in-person visits.

Furthermore, many companies are investing in robust wellness programs that promote healthy employee behaviors, such as smoking cessation, weight management, and stress reduction. These programs aim to improve employee health, reduce the incidence of chronic diseases, and ultimately lower overall healthcare spending. Negotiating directly with providers or forming employer coalitions to leverage purchasing power are other avenues employers explore to secure better rates for services and prescription drugs.

Policy and Regulatory Changes

Policymakers face the daunting task of balancing access to care, quality of services, and cost containment. Potential policy changes for 2025 and beyond could include efforts to increase price transparency, requiring hospitals and insurers to disclose their negotiated rates more clearly. This move aims to empower consumers to make more informed decisions and foster greater competition among providers. Discussions around prescription drug pricing reforms, such as allowing Medicare to negotiate drug prices or importing drugs from countries with lower costs, are also ongoing and could significantly impact future expenditures.

Legislative changes could also focus on strengthening primary care and preventative health initiatives, recognizing that investing in upstream care can reduce downstream costs associated with acute and chronic conditions. Expanding access to mental health services and addressing social determinants of health (factors like housing, food security, and transportation that impact health outcomes) are also areas policymakers are exploring to improve public health and potentially reduce long-term healthcare spending. The political will and bipartisan cooperation required for substantial reforms, however, remain a significant challenge.

The Role of Technology and Innovation in Cost Management

Technology and innovation are not only drivers of increased healthcare costs but also offer promising solutions for cost management and delivery efficiency. The judicious application of digital tools, data analytics, and artificial intelligence holds the potential to streamline processes, improve diagnostic accuracy, and personalize care, leading to more cost-effective outcomes. Embracing these advancements responsibly is key to navigating the future of healthcare.

The widespread adoption of telemedicine, accelerated by recent global events, demonstrates how technology can reduce the overhead associated with in-person visits, such as transportation costs and time off work. Telehealth platforms provide convenient access to consultations, remote monitoring of chronic conditions, and prescription refills, often at a lower cost than traditional office visits. This shift to virtual care models can improve access to specialists in remote areas and reduce the burden on emergency rooms for non-urgent conditions.

Data Analytics and Personalized Medicine

Big data analytics is transforming healthcare by enabling providers to identify patterns, predict outcomes, and personalize treatment plans. By analyzing vast datasets of patient information, clinical trials, and population health trends, healthcare systems can gain insights into effective treatments, identify at-risk populations, and optimize resource allocation. This data-driven approach can lead to more precise diagnoses, reduce unnecessary tests, and improve the efficiency of care delivery, thereby containing costs.

Personalized medicine, although often involving high initial costs for genetic testing or specialized therapies, holds the long-term promise of preventing disease or targeting treatments more effectively, reducing the need for trial-and-error approaches and subsequent expensive interventions. Tailoring therapies to an individual’s genetic makeup and lifestyle can improve efficacy and avoid adverse drug reactions, ultimately saving costs associated with ineffective treatments or complications.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are beginning to revolutionize various aspects of healthcare, from administrative tasks to clinical decision-making. AI-powered tools can automate billing, scheduling, and claims processing, reducing administrative overhead and freeing up healthcare professionals for patient care. In clinical settings, AI can assist in analyzing medical images for early disease detection, enhancing diagnostic accuracy, and optimizing treatment protocols.

Robotics in surgery, while expensive to implement, can lead to less invasive procedures, shorter hospital stays, and quicker patient recovery, ultimately reducing overall costs associated with complex operations. The use of AI in drug discovery and development can also accelerate the process of bringing new treatments to market, potentially reducing research costs and making effective medications available sooner. While the initial investment in these technologies can be substantial, their potential for long-term cost benefits and improved patient outcomes is significant.

Navigating the Future of Healthcare Costs with Preparedness

The trajectory of healthcare costs into 2025 and beyond indicates persistent upward pressure, driven by a complex interplay of economic, demographic, and technological factors. From inflationary pressures and an aging population to groundbreaking medical innovations and the burden of chronic diseases, a multitude of forces coalesce to shape the financial landscape of healthcare. For individuals, employers, and policymakers, this evolving environment necessitates a proactive approach grounded in awareness and strategic planning.

For individuals, preparation means a deliberate focus on financial well-being and personal health. This includes leveraging tax-advantaged savings vehicles like HSAs and FSAs, diligently reviewing and optimizing health insurance plans, and prioritizing preventative care and healthy lifestyle choices. These measures empower individuals to navigate rising costs, reduce out-of-pocket expenses, and proactively manage their health needs.

Employers are pivotal in this equation, exploring innovative benefit designs, investing in employee wellness programs, and seeking efficiencies in healthcare delivery. Their efforts not only support their workforce but also contribute to broader systemic improvements. Policymakers, on the other hand, face the monumental task of enacting reforms that promote transparency, curb drug prices, and bolster primary care, aiming for a more equitable and sustainable healthcare system.

The advent of technology, while a cost driver, paradoxically presents some of the most promising solutions for mitigating future expenses. Telemedicine, data analytics, and artificial intelligence offer pathways to more efficient, precise, and personalized care, ultimately contributing to better outcomes at potentially lower costs. The effective integration of these innovations will be crucial in shaping a more affordable and accessible healthcare future. Ultimately, navigating the projected increases in healthcare costs requires a collective, concerted effort, blending personal responsibility with systemic reforms and technological foresight.

| Key Point | Brief Description |

|---|---|

| 📈 Cost Drivers | Inflation, aging population, tech advancements, and chronic diseases fuel cost hikes. |

| 💰 Individual Preparation | Utilize HSAs/FSAs, optimize insurance, and prioritize preventative care. |

| 🏢 Employer & Policy Roles | Employers implement wellness; policymakers push transparency and drug price reform. |

| 💻 Tech Solutions | Telemedicine, AI, and data analytics help manage costs and improve care efficiency. |

Frequently Asked Questions About Healthcare Costs

The main factors include general economic inflation, an aging population requiring more care, the rising prevalence of chronic diseases, and the continuous advancement and high cost of new medical technologies and prescription drugs. Supply chain issues also contribute to increased operational expenses for healthcare providers, which are then passed on to consumers.

Individuals can prepare by maximizing contributions to Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). It’s also crucial to regularly review health insurance plans to ensure optimal coverage, understand deductibles and out-of-pocket maximums, and maintain an emergency fund specifically for medical expenses. Prioritizing preventative care can also reduce long-term costs.

Employers are critical in this effort, often by offering diverse health plans, promoting wellness programs to encourage healthy employee behaviors, and utilizing telehealth services. Some employers also explore value-based care models or engage in direct negotiations with healthcare providers to secure more favorable rates and control overall benefit costs for their workforce.

Yes, while initially costly, technologies like telemedicine can reduce travel and facility expenses. Data analytics can optimize treatment plans and resource allocation, while AI and automation can streamline administrative processes and aid in more precise diagnoses. These innovations generally promise long-term efficiencies and improved patient outcomes, potentially offsetting some costs.

Government policies significantly influence healthcare costs through regulatory changes, proposals for prescription drug price negotiation, and initiatives aimed at increasing price transparency. Efforts to strengthen primary care and address social determinants of health also aim to improve public health and reduce long-term expenditures. However, the exact impact depends on policy implementation and economic factors.

Conclusion: Proactive Steps for a Sustainable Healthcare Future

The anticipated increases in healthcare costs for 2025 underscore a persistent challenge that demands attention from every segment of society. While the complex web of economic, demographic, and technological factors driving these costs shows no immediate signs of abating, the outlook is not without actionable solutions. Preparedness, both at the individual and systemic levels, emerges as the most potent defense against escalating expenses. By embracing sound financial planning, optimizing health insurance choices, and prioritizing preventative care, individuals can build resilience against unexpected medical bills. Concurrently, employers and policymakers must continue to innovate and advocate for reforms, leveraging technology to foster a more efficient, transparent, and ultimately, sustainable healthcare ecosystem. The journey toward managing these costs effectively is ongoing, but through informed action and collaborative effort, a healthier and more financially secure future for all remains within reach.